4 Factors Investors Should Watch in 2026

As we head into a new year, there is certainly no shortage of storylines to follow. What’s been lacking is reliable data to frame our understanding of events and stories. Much of the economic information released late in 2025 was distorted by the lingering effects of the government shutdown, making it difficult to separate signal from noise.1

1 J.P. Morgan. December 12, 2025.

Here are four factors I’ll be watching closely.

A Fresh Set of Economic Data

4 Factors Investors Should Watch in 2026

Inflation appeared to cool late last year, with the year-over-year rate easing to 2.7% in November from 3.0% in September. But investors should treat that number cautiously. There was no October inflation report, and November’s data collection resumed just as retailers were cutting prices around Black Friday. Seasonal adjustments struggled to account for that timing, likely biasing the headline figure lower.

One more inflation report will arrive before the Federal Reserve’s next meeting, but January and February prints should be far more informative. Many companies reset prices at the start of the year, and with clean data collection back in place, those readings should offer a clearer inflation picture, which will, of course, feed into interest rate expectations.

The labor market is sending similarly mixed signals. Payrolls rose by 64,000 in November, yet the unemployment rate increased to 4.6% from 4.4% in September. That combination raised concerns about a sharper slowdown, but timing played a role here as well. Shutdown-related delays blended October and November data together, and when federal layoffs are stripped out, private-sector job growth looks broadly consistent with this year’s slower, but still positive, trend.

The Fed appears to now be more focused on the jobs market versus inflation, but new data early in the year could reset the narrative.

Monetary Policy Could Shift from Neutral to Accommodative

4 Factors Investors Should Watch in 2026

Monetary policy will follow the labor and inflation backdrop. Following the 25 basis point cut in December, the Federal Reserve has shifted into “wait-and-see” mode, but that stance may not last long. Chair Jerome Powell’s term ends in May, and political pressure for lower rates has become more pronounced.

What will matter, in my view, is whether softer labor market data and easing inflation give the Federal Reserve room to move from a neutral posture toward something more supportive. Even a modest shift in tone could influence financial conditions, valuations, and investor risk appetite. Historically, markets tend to price these changes well before they are formally announced.

Turbulence in Trade Policy

4 Factors Investors Should Watch in 2026

A Supreme Court ruling on the administration’s use of emergency powers under the International Emergency Economic Powers Act (IEEPA) is expected later this month. If the Court strikes down or narrows the current tariff framework, the implications across Corporate America could be immediate.

But that doesn’t mean uncertainty would go away overnight.

The administration has made clear that they would pursue other avenues for implementing tariffs, such as Section 301 investigations, national security-related tariffs under Section 232, or temporary measures under Section 122 of the Trade Act. These alternatives are more targeted and often slower to implement, which I think could reduce near-term economic drag as businesses take advantage of the opening. But I also think it’s true that tariffs would ultimately remain part of the policy mix.

Overall, I think a drawn-out transition toward narrower, more deliberate trade actions could give businesses time to plan, adjust supply chains, and rebuild inventories—a meaningful difference from abrupt, sweeping tariff changes.

Earnings Growth May Broaden Beyond a Narrow Group of Leaders

4 Factors Investors Should Watch in 2026

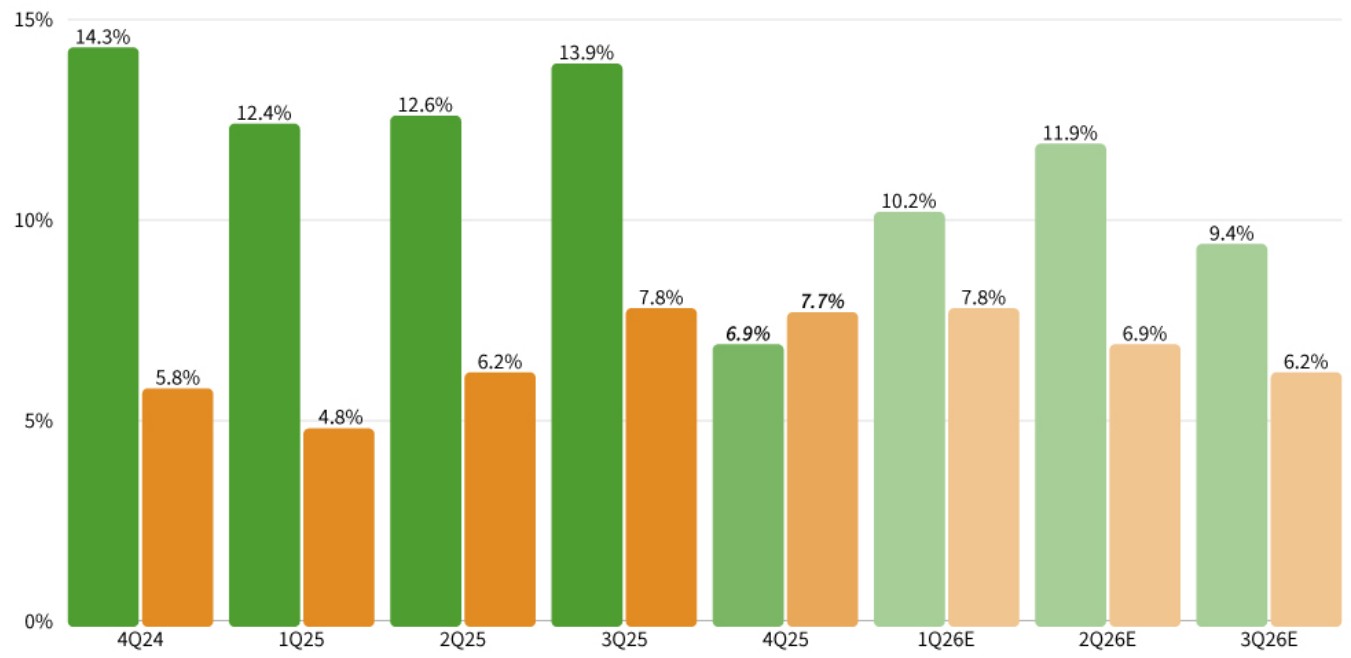

Finally, investors should watch how earnings leadership evolves. Technology has been driving overall earnings growth since Q3 2023, and according to our colleagues at Zacks Investment Research, the sector is still expected to be a major growth driver in Q4 2025 and full year 2026.

But we also think the earnings picture is poised to broaden.

Other sectors are projected to post stronger growth rates in 2026, contributing more meaningfully to overall profit expansion. As seen on the chart below, we’re expecting S&P 500 earnings to accelerate through the second quarter, even as Tech earnings decelerate (while remaining nominally strong).

Quarterly Earnings & Revenue Growth (YoY)

This matters because durable market advances rarely depend on a single group of stocks. Broader earnings growth tends to support more resilient market leadership and reduces reliance on a narrow set of outcomes. Investors should keep an eye on sector-level earnings revisions and margins as the year progresses, looking broadly for opportunities.

Bottom Line for Investors

Early 2026 will be a critical period that could set the stage for the year, in my view. Investors will finally receive cleaner economic data, greater clarity on policy, and a better sense of where earnings growth is coming from. That doesn’t mean uncertainty disappears, as funding deadlines, policy transitions, and legal rulings still loom. But it does mean the inputs driving markets should become clearer.

The goal isn’t to predict every outcome. It’s to monitor the conditions that tend to drive them, i.e., watch the data, the policy landscape, and the breadth of earnings growth. These will matter more than any single headline as the year unfolds.

The more important question, then, is how these conditions translate across the market, and what they imply for positioning.